It also means that government bonds issued with negative returns will result in bondholders receiving a total amount of interest below the price they paid for this debt. January 2015 the Central Bank of Denmark DNB decided to impose a negative rate on.

Governments imposing negative nominal interest rates are attempting to encourage consumption by discouraging saving Unemployment rates in the United States from 2005 to.

. If the UK introduces negative interest rates the value of gold is likely to increase. I assume that the central bank uses the inter-est rate as its policy instrument and follows a Taylor rule. Governments imposing negative nominal interest rates are attempting to A.

Where Rt is the one-period nominal interest rate Wt is nominal wealth at the beginning of period t Ht are nominal transfers from the government taxes if negative and Pt is the price level in period t. The implementation of negative policy rates represents a new macroeconomic policy experiment. Dencourage consumption by discouraging saving.

Bernanke 2012 argues that nominal interest rates are zero-bound essentially ruling out the possibility of negative nominal interest rates. Governments imposing negative nominal interest rates are attempting to Adiscourage the use of banks. Discourage the use of banks.

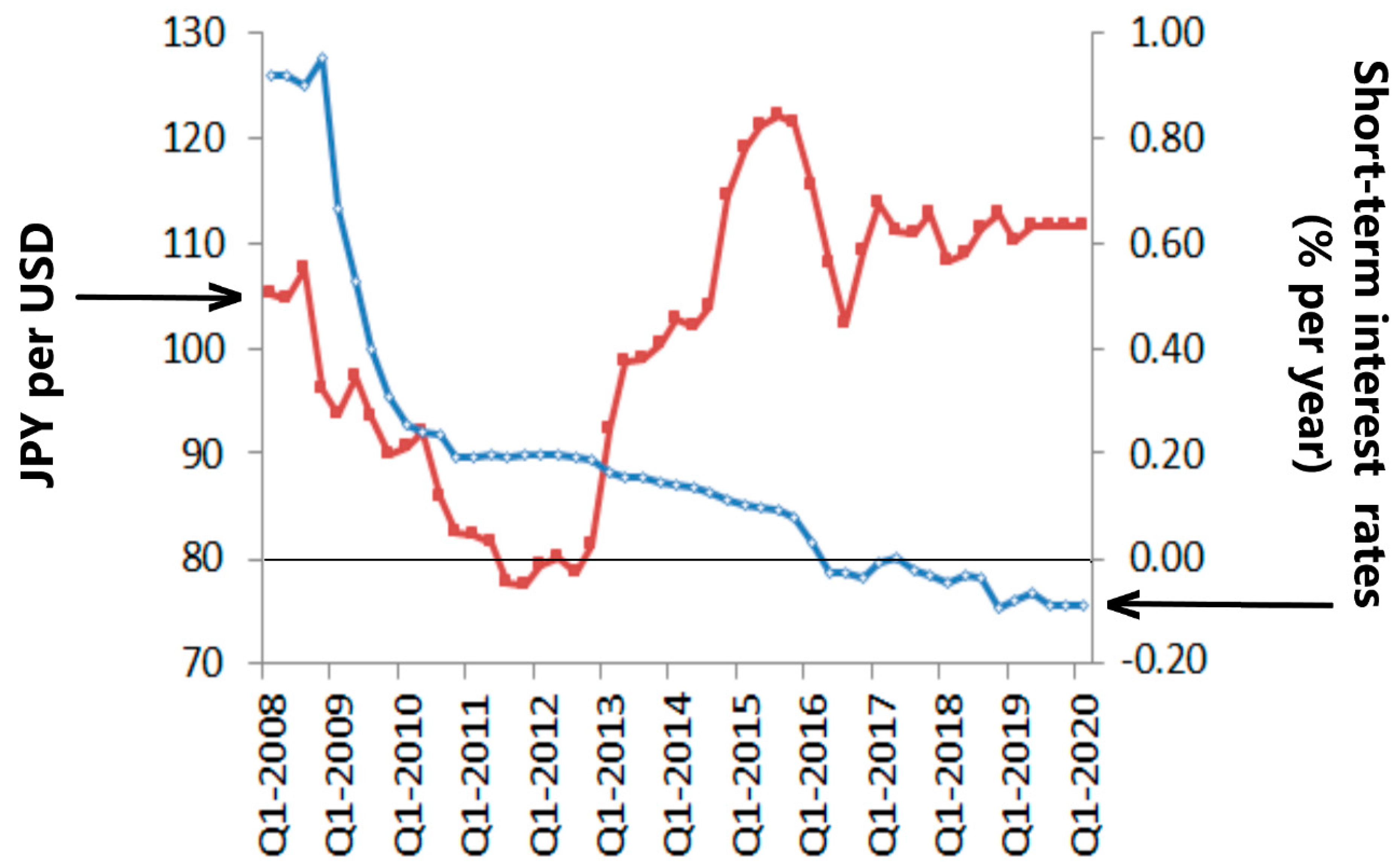

We could imagine a government-engineered reserve requirement the shutting down of competing networks for trading reserves and then the government raises the tax on those reserves to bring about negative nominal interest rates. Nominal three-month interbank rates 2007-October 2019. Understanding how negative nominal interest rates fft the economy is important in.

Dencourage consumption by discouraging saving. Interest rates are now negative below zero for a growing number of borrowers mainly in the financial markets. QUESTION 13 Governments imposing negative nominal interest rates are attempting to discourage the use of banks.

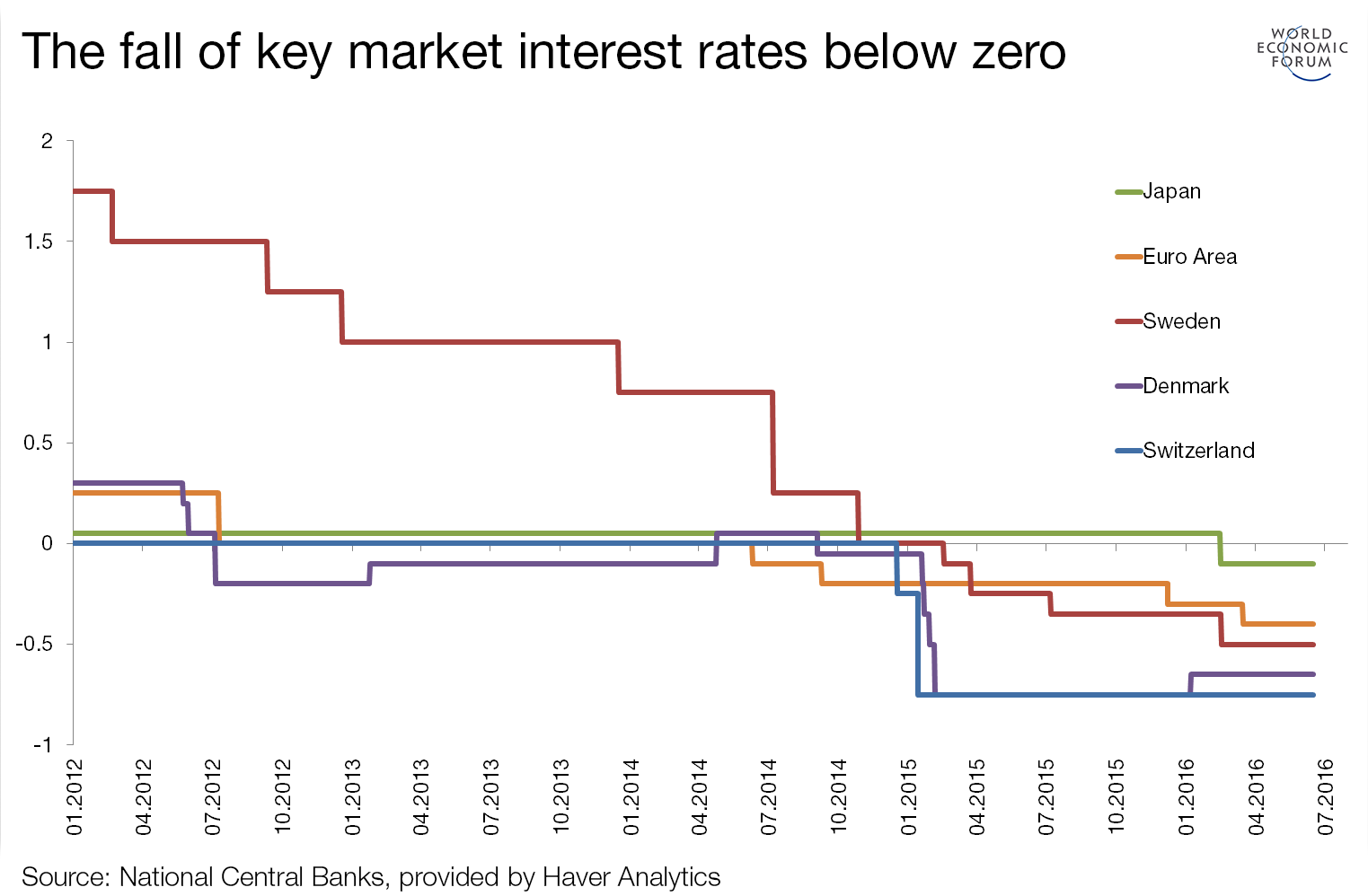

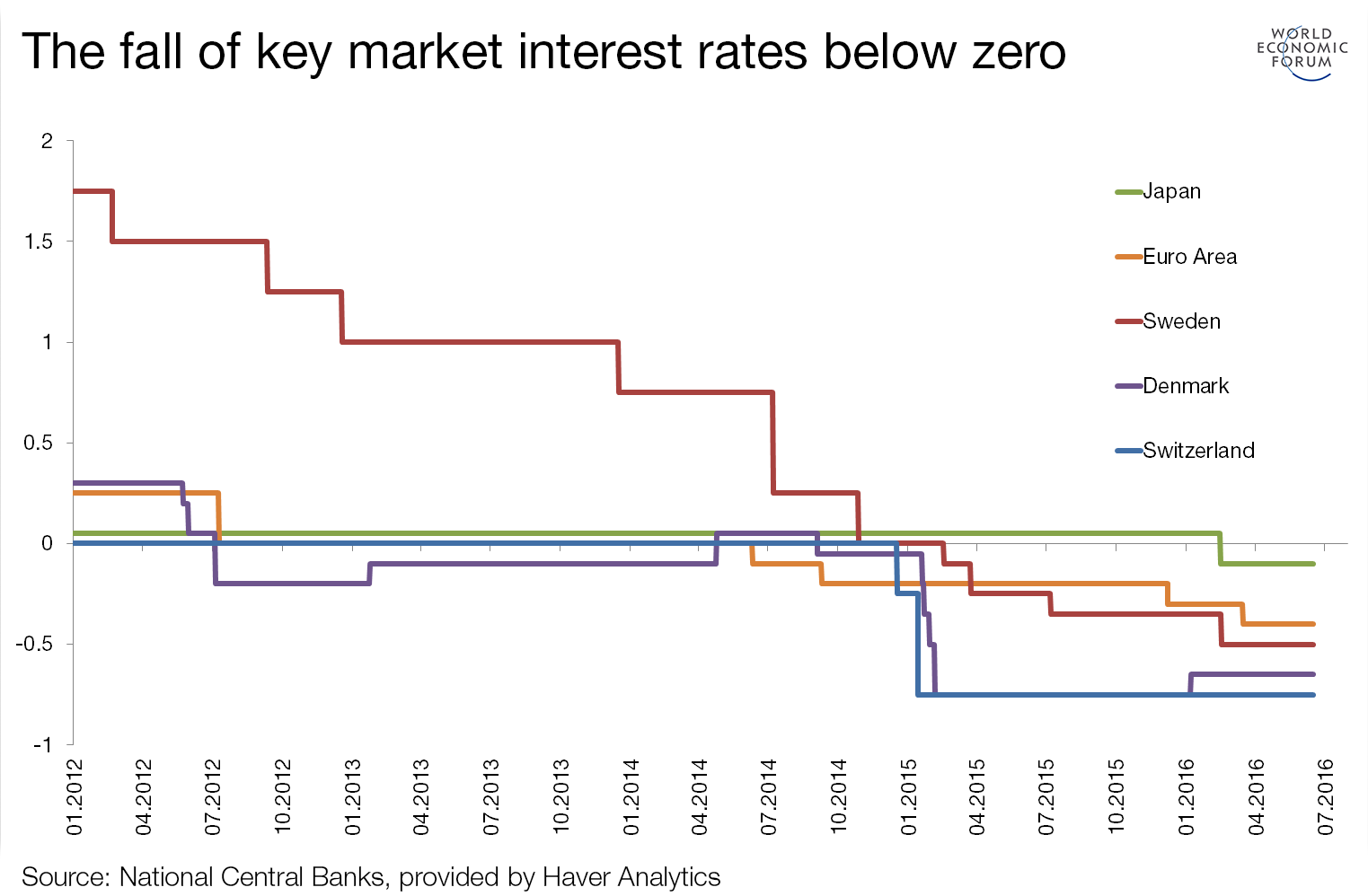

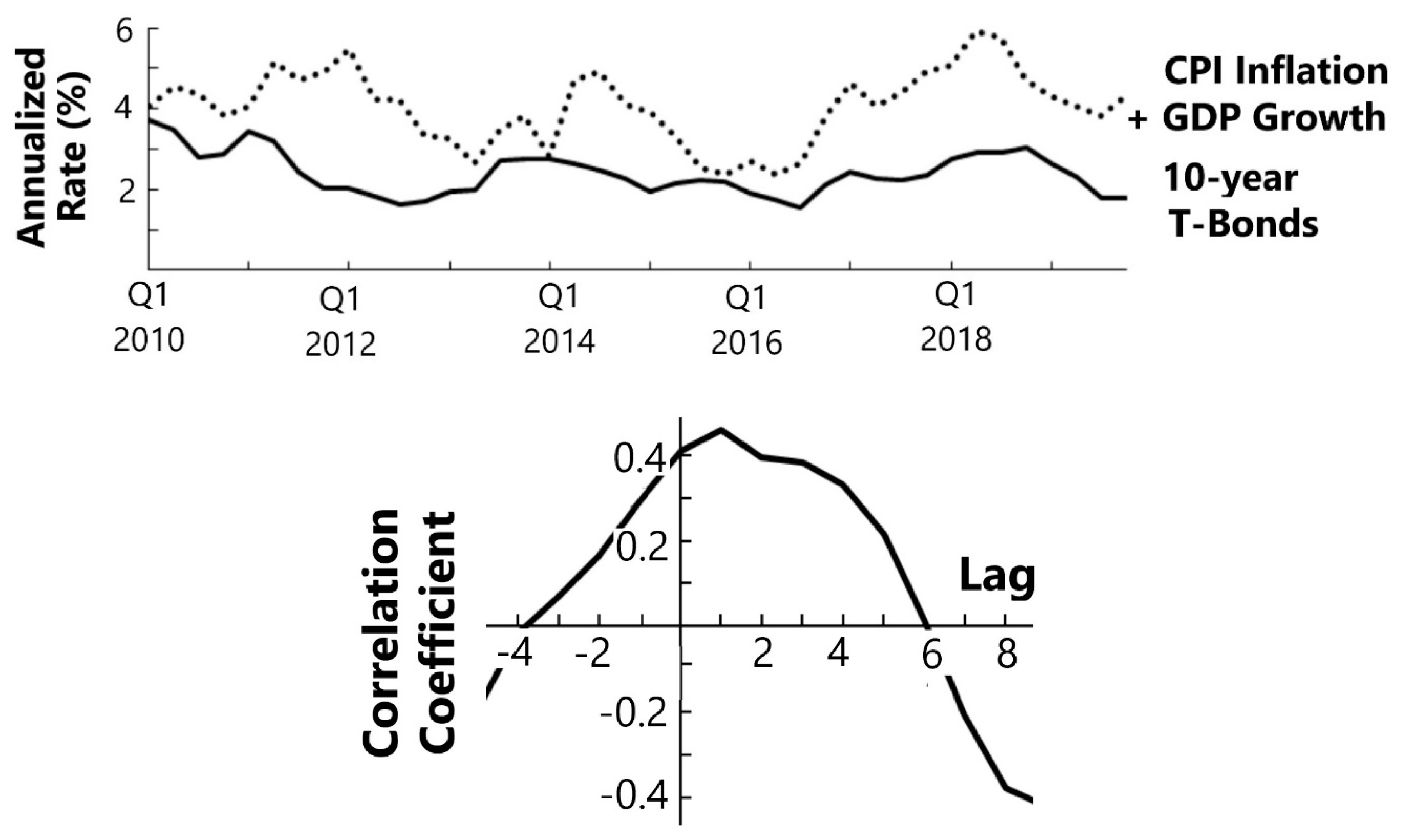

Yet as of mid-2016 the government bonds reflecting about one-third of global economy had negative nominal interest rates the Euro area Japan Sweden Denmark and Switzerland. IntroductionThere is a notable asymmetry in the design and implementation of monetary policy. To date there is no consensus on the ffs of negative nominal interest rates - either empirically or theoretically.

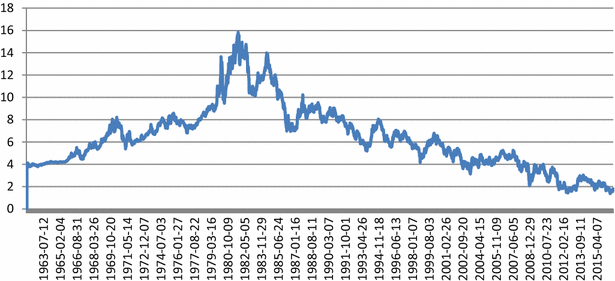

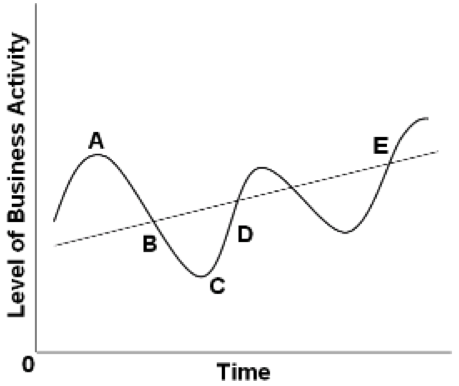

During boom times when the economy is overheating and inflation threatens to rise to undesirable levels the Central Bank can raise the official policy rate a short risk-free nominal interest rate typically the target for the. The introduction of a negative interest rate will see these bonds yield fall further and possibly encourage investors to move away from bonds and look at other safe investments. This can be done with or without the existence of zero-interest.

Governments imposing negative nominal interest rates are attempting to discourage the use of banks. The interest rate paid on excess reserves in the United States is quite a bit higher than those offered by the ECB and the BOJ. There is another way to get negative nominal interest.

It means in effect they are. Cdiscourage consumption and encourage saving. Discourage consumption and encourage saving.

Encourage consumption by discouraging saving. Recently attention has focused on the large volume of long-term bonds with negative nominal yields see chart. 4 Rt rl3 F7T - Tr.

The Bank of Japan BOJ keeps trying to print Japan back to economic prosperity and it is not letting 25 years of failed stimulus policies get in. This paper contributes to lling this gap. Discourage consumption and encourage saving.

Put simply if your contract with the bank stipulated for instance a 2 annual rate on your deposit and the inflation rate reached 4 in that year youd have incurred a real loss. Negative nominal rates have reinforced forward guidance in the euro area sped up the process of portfolio rebalancing. In addition to this straightforward influence of negative nominal rates on real rates setting negative nominal rates may stimulate the economy in less predictable and clear ways.

The BOJ has a tiered interest rate on reserves and the lowest rate was lowered from 010 percent to -010 percent on January 29 2016. Today short-term money market rates in Denmark Germany and much of the euro area Japan Sweden and Switzerland all remain below zero see chart. Compete with private banks in the lending market.

Nominal interest rates cannot be negative. There would be a simple pure arbitrage opportunity for anyone able to borrow at a negative nominal interest rate and invest in currency. Cdiscourage consumption and encourage saving.

It stood at 235 percent prior to August 1 2019 when the Board of Governors of. Compete with private banks in the lending market. And supported the effectiveness of the recent targeted longer-term refinancing operations.

Negative nominal rates mean that private banks are charged for storing money in the central bank a cost that private banks have only passed on to their large-sum depositors and savers so far. Compete with private banks in the lending market. This is also likely to increase investment in gold.

Discourage consumption and encourage saving. For example setting a negative nominal policy ratea move that is by nature unconventionalmay surprise people and thereby send a strong signal of the central banks. Treasury Bill with a negative nominal interest rate would be dominated by currency as a store of value.

Bcompete with private banks in the lending market. Encourage consumption by discouraging saving. This was not caused by nominally negative interest rates but rather by the fact that contractual nominal interest rates were lower than the rate of inflation.

Negative nominal interest rates are counter-intuitive even when negative real rates have been. Governments imposing negative nominal interest rates are attempting to Adiscourage the use of banks. The reason no interest at a positive or at a negative rate is paid on currency is that it.

Encourage consumption by discouraging saving. As long as all interest rates move in tandem including the rate of return on paper currency economic theory suggests no important difference between interest rate changes in the positive region and interest rate changes in the negative regionIndeed in standard models only the real interest rate and spreads between real interest rates matter. Benoît Cœuré July 2016overall as a.

If The Real Interest Rate And The Nominal Interest Rate Are Both Negative And Course Hero

Jrfm Free Full Text Negative Interest Rates Html

Negative Interest Rates Absolutely Everything You Need To Know World Economic Forum

Negative Interest Rates Causes And Consequences Springerlink

0 komentar

Posting Komentar